Disney, NBC Turn to Sports Betting and Technology as Search for New Revenue Intensifies

The National Basketball Association’s new season marks a major shift in U.S. sports media, as NBC returns to NBA broadcasting after a 23-year hiatus and Amazon Prime Video joins as a new partner. With both companies investing billions in rights fees, the deals underscore how traditional and digital platforms are seeking innovative ways—including sports betting and technology partnerships—to offset the soaring cost of live sports rights and develop new revenue streams.

NBC Sports is reportedly paying about $2.45 billion per year for 100 regular-season games, the All-Star Game, and playoff coverage under an 11-year agreement. Some games will stream exclusively on Peacock, while others will air on NBC. Amazon will pay around $1.8 billion annually for 67 regular-season contests, six play-in tournament games, and one-third of all first- and second-round playoff matchups.

The financial scale of these contracts has prompted scrutiny over NBCUniversal’s ability to recoup its investment. According to The Wall Street Journal, NBC is projected to lose between $500 million and $1.4 billion per year during the early years of the deal. Despite those projections, network executives are betting that long-term growth in advertising, streaming subscriptions, and related ventures will help balance the costs.

Basketball hoop | Source: Pexels

NBC is already seeing strong advertiser interest. The Journal reported that NBC has averaged about $130,000 per 30-second commercial for regular-season NBA broadcasts—more than double TNT’s previous $50,000 average. The higher rates are attributed to NBC’s broad reach across both broadcast television and streaming platforms. NBC is accessible through cable and digital bundles reaching roughly 65 million U.S. households, and its over-the-air signal extends to millions more.

Beyond advertising, NBC is counting on live NBA coverage to boost Peacock’s subscriber base. The service, which recently raised prices to $10.99 per month with ads and $16.99 without, is central to NBCUniversal’s direct-to-consumer strategy. Sports programming has been key to sustaining subscriber growth and supporting retransmission fee increases during carriage negotiations with major pay-TV providers such as Charter, DirecTV, and YouTube TV.

While traditional broadcasters continue to rely heavily on advertising and subscription models, they have yet to create a significant new revenue stream directly tied to sports rights. Industry executives see opportunities in sports betting and emerging technologies as potential breakthroughs. Earlier this month, NBCUniversal announced a partnership with DraftKings to integrate betting content into its sports coverage. Amazon followed with a similar collaboration with FanDuel, signaling a growing alignment between media companies and betting platforms.

Other potential partnerships could emerge as prediction markets such as Kalshi and Polymarket expand into sports-related wagering. Meanwhile, new technologies are offering alternative ways to experience live sports. For example, Cosm has secured agreements with traditional broadcasters to present live games in dome-like immersive venues, pointing to new forms of audience engagement.

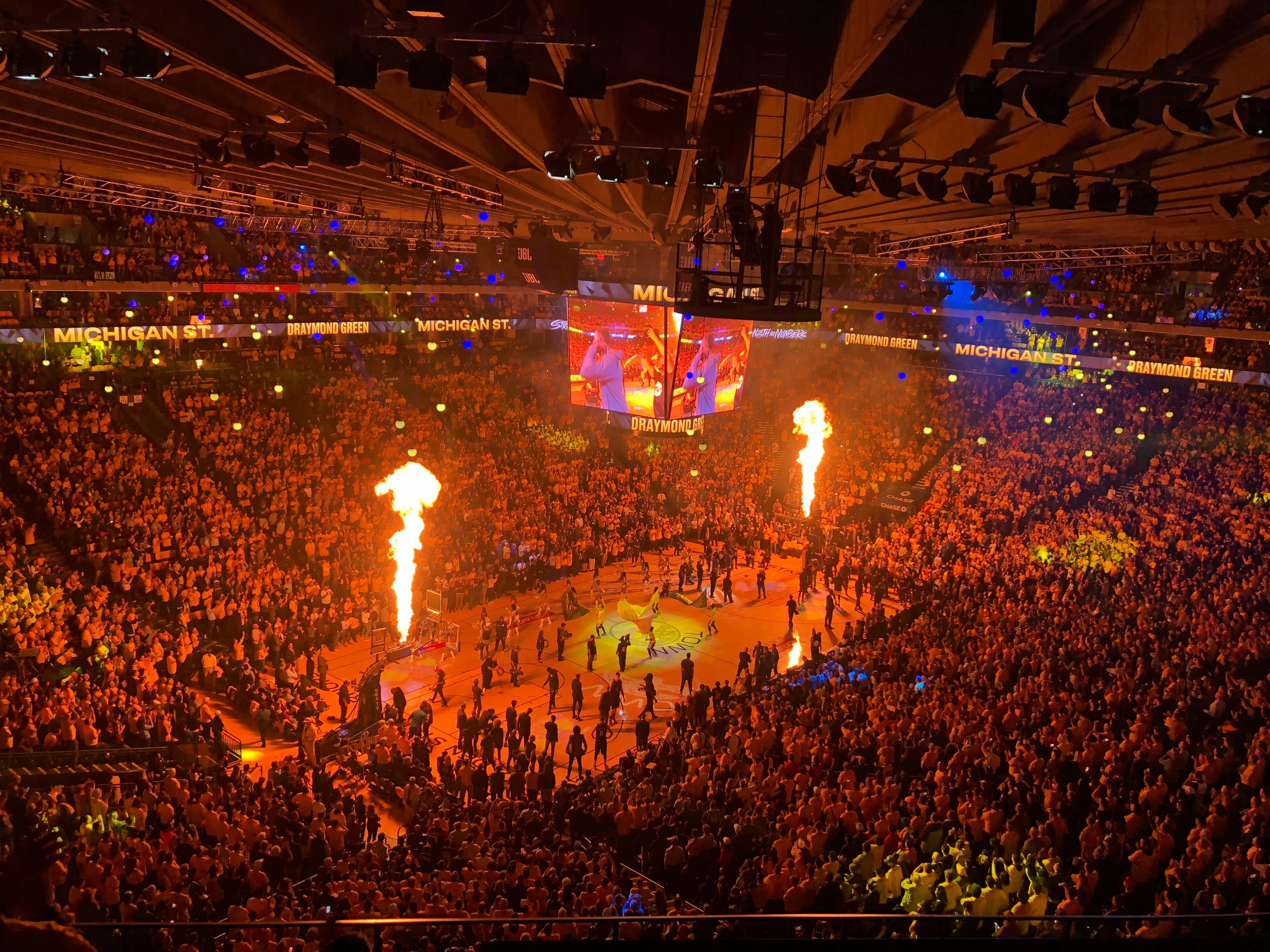

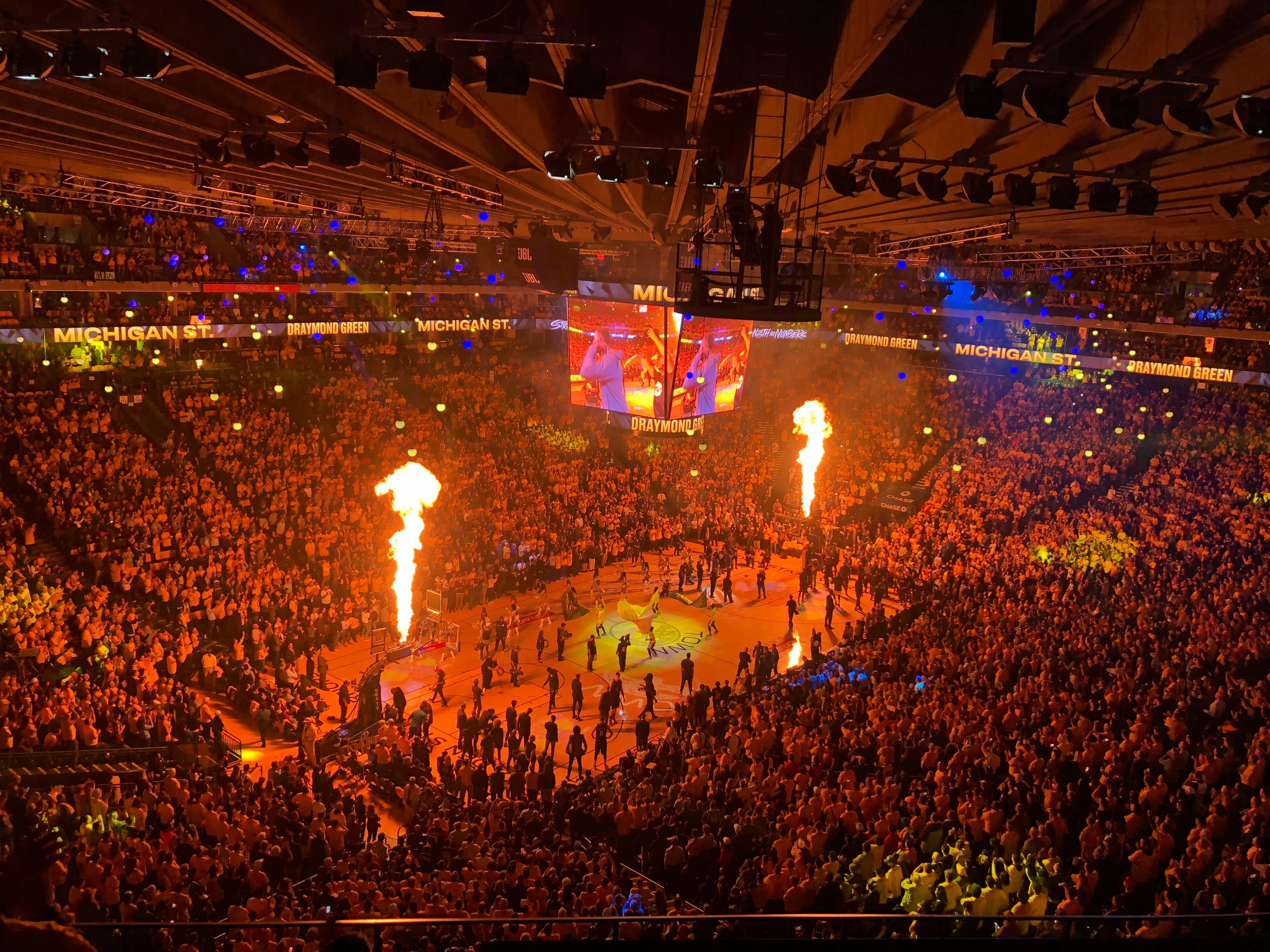

Basketball court | Source: Pexels

Technology integration could also strengthen existing ecosystems. Apple, which owns rights to Major League Soccer and will stream Formula 1 races beginning in 2026, leverages its hardware and software integration to deepen consumer loyalty. Amazon similarly ties sports programming to its broader Prime ecosystem, encouraging new memberships and increased purchasing activity.

NBCUniversal’s approach appears to follow that model by linking media rights to complementary businesses. Its Golf Channel, soon to be folded into Versant, has successfully promoted GolfNow, a tee-time booking platform that has become highly profitable through cross-promotion.

Industry observers note that while a major new revenue stream may not materialize soon, maintaining high-profile sports rights remains essential for network viability. Despite initial losses, long-term contracts often prove advantageous. As NFL Commissioner Roger Goodell recently noted regarding his league’s 2021 media rights deal, “the league left a lot of money on the table.”

For NBC and Amazon, the NBA partnership represents both a financial gamble and a strategic investment. In an era of cord-cutting and shifting viewer habits, live sports remain one of the few content categories that guarantee large, engaged audiences—and the potential foundation for the next wave of media innovation.